Income tax signed into law

A personal income tax will be introduced for the first time.

18 Dec 2019, 09:00

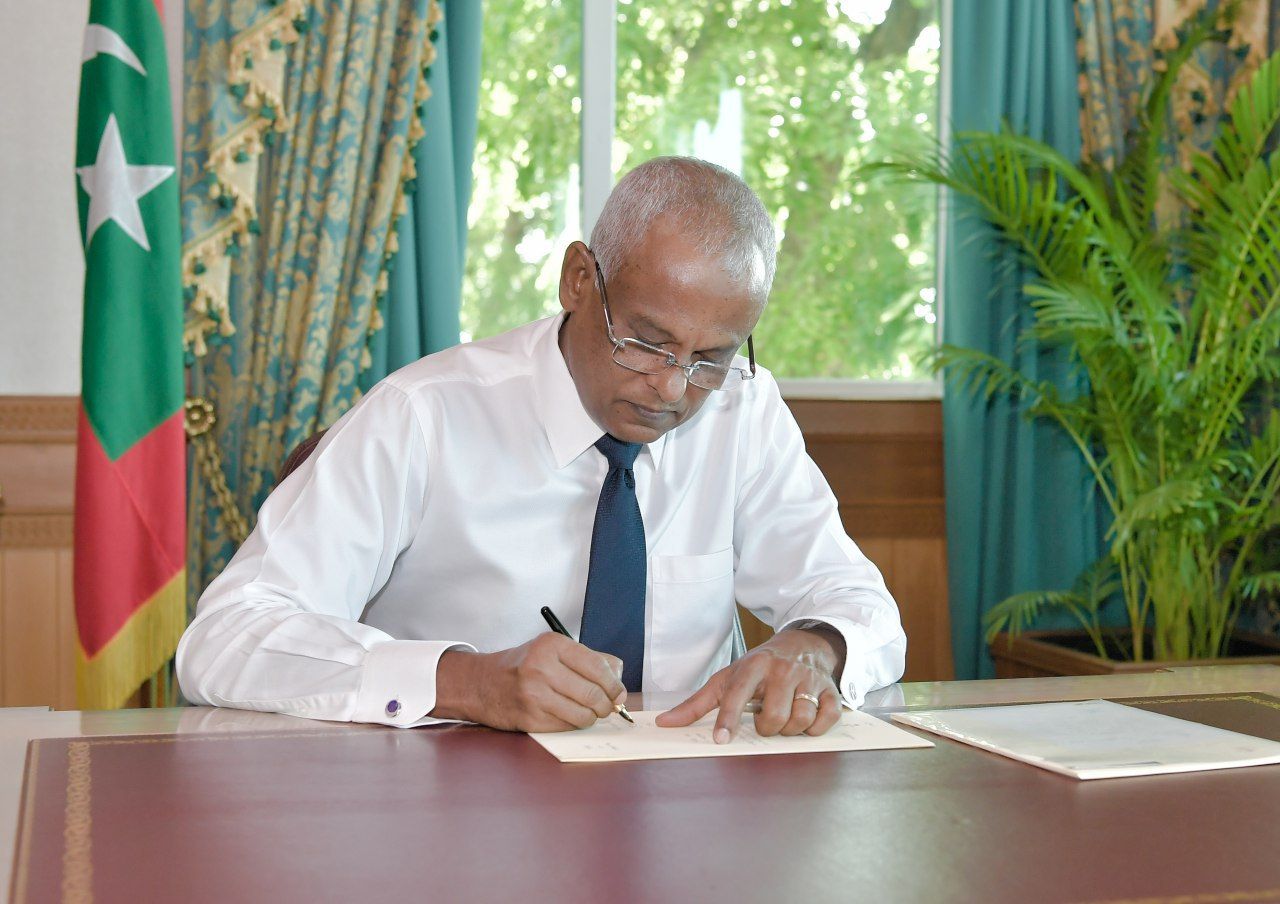

President Ibrahim Mohamed Solih on Tuesday ratified legislation passed by parliament to introduce a progressive income tax as pledged during his campaign for the 2018 election.

The law comes into force on January 1, 2020 but employee income will become taxable after April. The existing business profit tax, bank profit tax and withholding tax for non-residents will be incorporated under the new law with a more comprehensive capital gains tax regime whilst the existing land sales tax and remittance tax on expatriates will be abolished next year.

The annual personal income tax is divided into five brackets:

Below MVR720,000 (US$46,692) – 0%

MVR720,000 to MVR1,200,000 – 5.5%

MVR1.2 million to MVR1.8 million – 8%

MVR1.8 million to MVR2.4 million – 12%

Above MVR2.4 million – 15%

Become a member

Get full access to our archive and personalise your experience.

Already a member?

Discussion

No comments yet. Be the first to share your thoughts!

No comments yet. Be the first to join the conversation!

Join the Conversation

Sign in to share your thoughts under an alias and take part in the discussion. Independent journalism thrives on open, respectful debate — your voice matters.