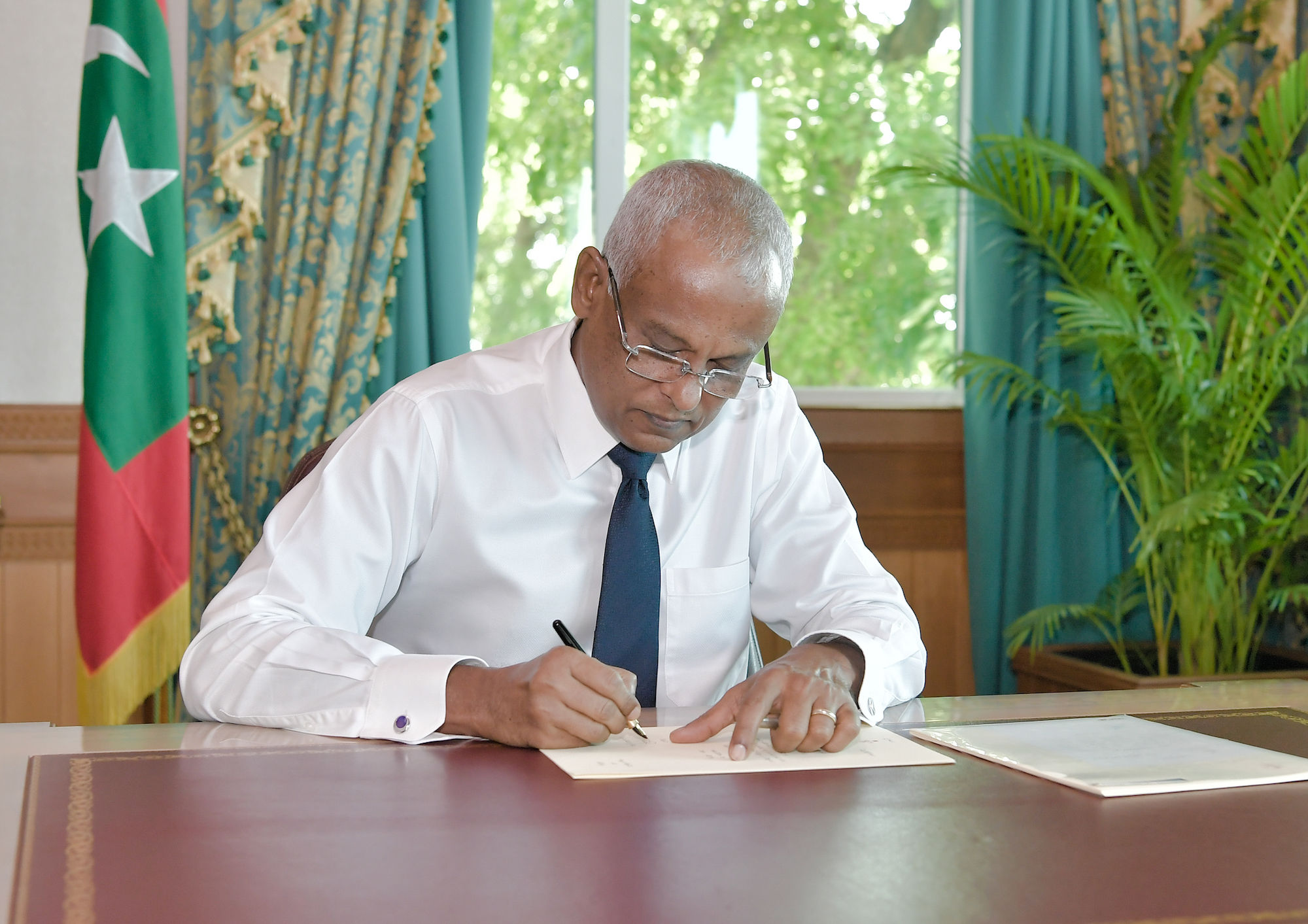

President ratifies new Maldives heritage law

Changes to the tax administration law were also ratified.

15 Sep 2019, 09:00

President Ibrahim Mohamed Solih on Thursday ratified a new heritage law that mandates the documentation, preservation and protection of Maldivian cultural heritage.

According to the president’s office, the Heritage Act specifies “procedures and jurisdictions” and criminalises “acts resulting in the loss of items or sites of historical significance.” The purpose of the new law is to “safeguard the perpetuation of items and sites of historical significance to future generations.”

The heritage ministry formed after the current administration took office in November is tasked with drafting regulations under the law and compiling a list of heritage items. The law also mandates the creation of a heritage protection agency with the authority to determine penalties for damage and vandalism. The export of heritage items is now prohibited.

The law covers craftwork, paintings, archaeological discoveries, historical documents, and old buildings.

Become a member

Get full access to our archive and personalise your experience.

Already a member?

Discussion

No comments yet. Be the first to share your thoughts!

No comments yet. Be the first to join the conversation!

Join the Conversation

Sign in to share your thoughts under an alias and take part in the discussion. Independent journalism thrives on open, respectful debate — your voice matters.