Maldives fails global anti-money laundering review: what you need to know

Global watchdog warns of political interference, zero convictions.

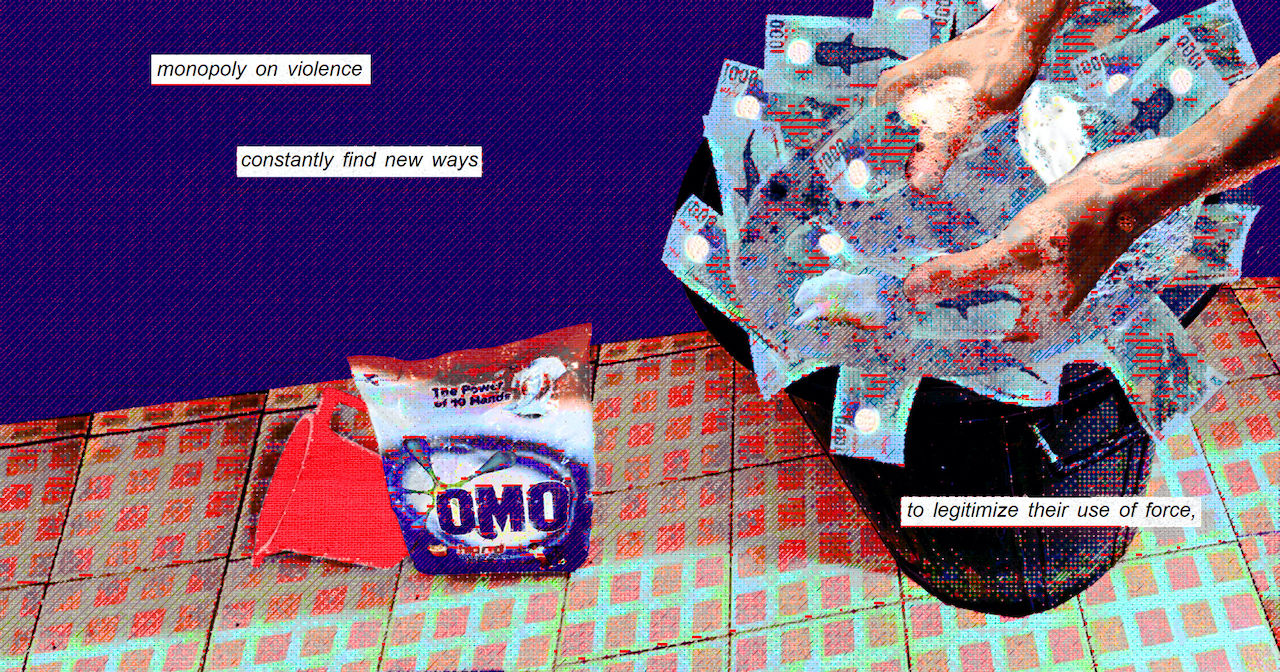

Artwork: Dosain

Since 2023, the Maldives has been "recognised as a strategic hub for heroin, cocaine, and cannabis trafficking, with established connections to organised crime networks in South and Southeast Asia."

The central bank's Financial Intelligence Unit indicated an increase in suspicious transactions flagged in 2023, "revealing the involvement of politically exposed persons (PEPs) in corruption, embezzlement, and misuse of authority through intermediaries such as family members and third parties."

State-owned enterprises were implicated in corrupt dealings in public procurement projects.

Scams became more sophisticated with "seemingly legitimate phishing emails and investment schemes that promise high returns for minimal fees." Other scams included fraudulent apartment sales, cryptocurrency transactions, recruitment fraud targeting migrant workers, internet banking fraud, and impersonation of financial institutions and government entities.

Discussion

No comments yet. Be the first to share your thoughts!

No comments yet. Be the first to join the conversation!

Join the Conversation

Sign in to share your thoughts under an alias and take part in the discussion. Independent journalism thrives on open, respectful debate — your voice matters.