Maldives pays US$271m in damages to India’s GMR

The government of the Maldives has paid US$271million in damages to Indian infrastructure firm, GMR, for the abrupt termination of a lucrative contract to develop and manage the country’s main airport.

17 Nov 2016, 09:00

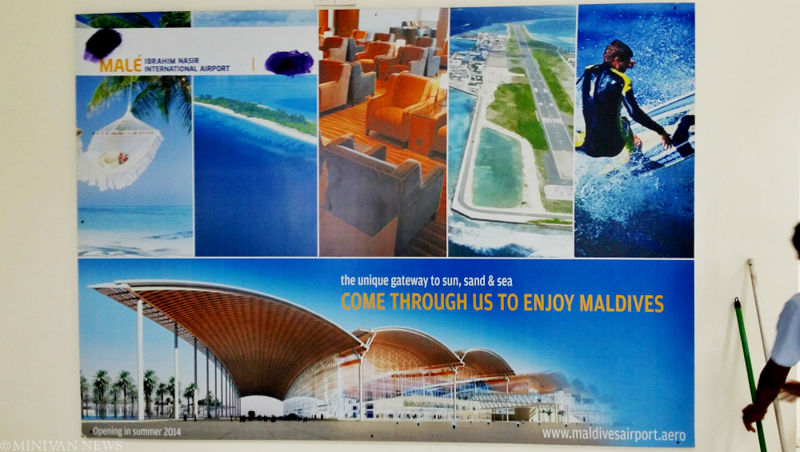

The government of the Maldives has paid US$271million in damages to Indian infrastructure firm, GMR, for the abrupt termination of a lucrative contract to develop and manage the country’s main airport.

Attorney General Mohamed Anil said that the state-owned Maldives Airports Company Ltd had settled the payment on Tuesday without drawing on the state budget.

Former President Mohamed Nasheed, whose government signed the contract with GMR in 2011, subsequently condemned his successor, Dr Mohamed Waheed Hassan, for terminating the deal against international law in a Twitter post. Waheed responded by defending the move as “the right decision for the Maldives.”

The pay out, ordered by a Singaporean Arbitration tribunal, includes the debt, equity invested in the project along with a return of 17percent, termination costs and legal costs.

Become a member

Get full access to our archive and personalise your experience.

Already a member?

Discussion

No comments yet. Be the first to share your thoughts!

No comments yet. Be the first to join the conversation!

Join the Conversation

Sign in to share your thoughts under an alias and take part in the discussion. Independent journalism thrives on open, respectful debate — your voice matters.