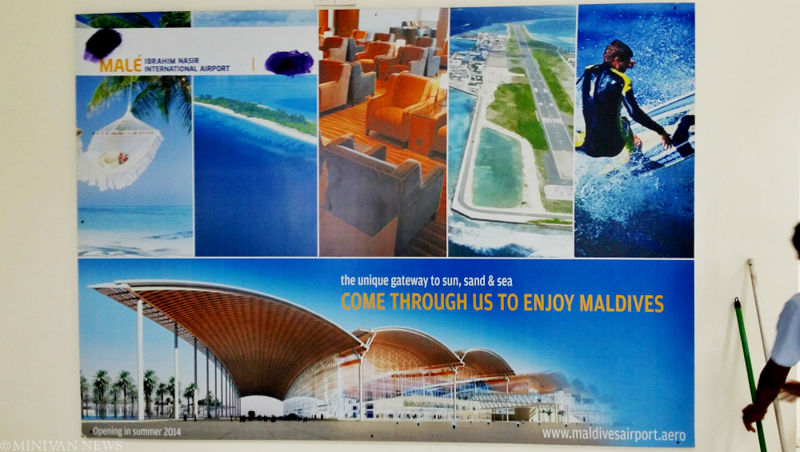

Maldives to pay Indian firm at least US$250m in damages for cancelling airport deal

Indian infrastructure firm, GMR, has won at least US$250million in damages from the Maldivian government for abruptly cancelling a lucrative contract to develop and manage the country’s main airport

28 Oct 2016, 09:00

Indian infrastructure firm, GMR, has won at least US$250million in damages from the Maldivian government for abruptly cancelling a lucrative contract to develop and manage the country’s main airport.

GMR said the award, which brings to an end a four-year legal battle, includes the debt, equity invested in the project along with a return of 17percent, and termination and legal costs.

The award, announced Wednesday, will amount to approximately US$270million, the firm said. But Attorney General Mohamed Anil estimated the figure to be US$250million, an amount far less than the GMR’s initial claim of US$1.4billion. The firm later revised the claim to US$803million.

Anil said the government and the state-owned Maldives Airport Company Ltd are currently in talks with GMR on making the payment. He refused to take questions from reporters citing “the confidential nature of arbitration proceedings.”

Become a member

Get full access to our archive and personalise your experience.

Already a member?

Discussion

No comments yet. Be the first to share your thoughts!

No comments yet. Be the first to join the conversation!

Join the Conversation

Sign in to share your thoughts under an alias and take part in the discussion. Independent journalism thrives on open, respectful debate — your voice matters.