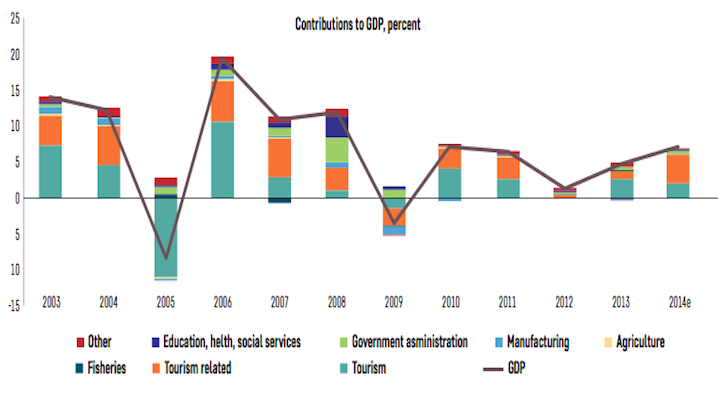

The government’s estimate for economic growth in 2015 is unrealistic with the performance of the tourism industry below expectations, says a World Bank report on South Asian economies.

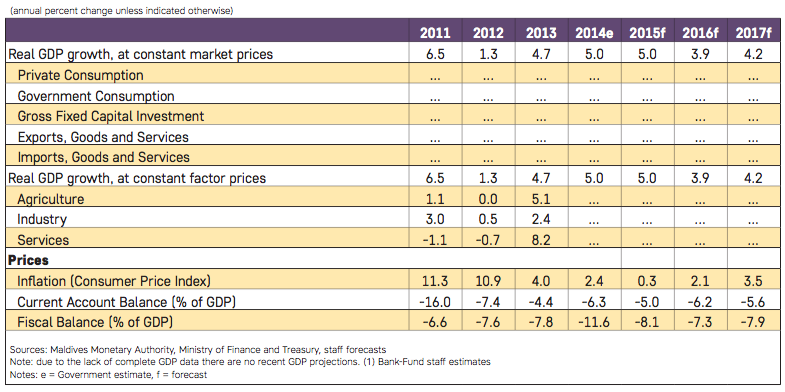

The government’s forecast for economic growth is 8.5 percent, but both the World Bank and the International Monetary Fund (IMF) expect the Maldivian economy to grow by 5 percent this year.

High levels of public debt “driven by high and rising public spending” is the immediate macroeconomic challenge facing the Maldives, observed the World Bank’s South Asia Economic Focus report released last week.

With government expenditure persistently outstripping income in recent years, public debt reached 75 percent of GDP or more than US$2 billion at the end of 2014.

“Limited reserves, a high level of public debt and the short maturity of domestic debt adds additional vulnerability,” the report stated.

“Meanwhile, continued domestic political unrest and a slowdown in major tourism-providing countries (China and European countries) might lead to reductions in tourism visits, which could put pressure on growth, revenue and the balance of payments.”

The report noted that investment opportunities outside tourism are limited, “and banks prefer to park their available assets at the central bank and abroad.”

As the government’s fiscal consolidation policies involved increasing one-off revenue, the World Bank suggested that the plans will not be enough to “bring public debt-to-GDP on a declining path” and advised raising revenue and reducing expenditure.

The government had said that the fiscal deficit in 2014 was 3.4 percent of GDP, but the World Bank put the figure at 11.6 percent of GDP.

“Despite high revenue of 32.4 percent of GDP, spending reached 44 percent of GDP, leading to a fiscal deficit es- timated at 11.6 percent of GDP in 2014. Tourism-related earnings have driven the increase in total revenue, but not enough to prevent a widening of the deficit,” the report stated.

The risk of external debt distress is moderate, it added, but the high public debt is “subject to vulnerabilities.”

Meanwhile, the Maldives Inland Revenue Authority (MIRA) revealed today that it has collected MVR10.4 billion (US$674 million) by the end of September. The government’s forecast for revenue in 2015 was MVR21.5 billion (US$1.3 billion).

The government had anticipated US$100 million as acquisition fees from investments in Special Economic Zones (SEZ) by August this year. However, large-scale foreign investments have not been forthcoming so far.

Income from SEZs was among US$220 million expected from new revenue raising measures, including hiking import duty rates, the introduction of a “green tax” in November, and leasing 10 islands for resort development.

The report meanwhile explained that goods imports and tourism services exports balance each other out, but “substantial outflows through interest payments, dividends and remittances kept the current account in a deficit at 6.3 percent of GDP.”

The gross official reserve reached US$693 million at the end of July 2015, “but usable reserves (net of short-term foreign liabilities) remained low at only US$214 million, covering about 1.3 months of imports of imports of goods and services.”

“However, the stable exchange rate of MVR 15.4 per USD and the parallel market premium do not signal any shortages, and in practice the tourism industry appears to supply sufficient quantities of foreign exchange at a stable premium over the official exchange rate,” the report stated.

The annual average CPI inflation meanwhile slowed down to 1.6 percent in July 2015 on the back of the global decline in commodity prices.

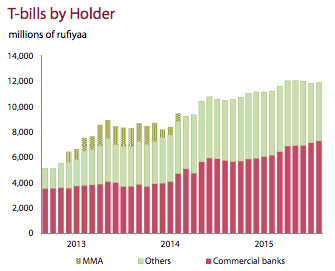

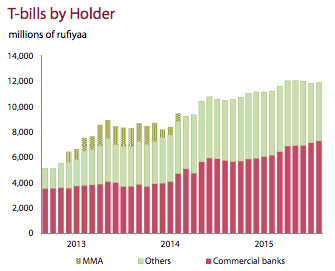

T-bills

Shortfalls were plugged through the sale of treasury bills (T-bills), he said. According to the Maldives Monetary Authority (MMA), the outstanding stock of government securities, including T-bills and T-bonds, reached MVR18.9 billion (US$1.2 billion) at the end of August.

The central bank has meanwhile slashed interest rates on T-bills with effect from October 28.

The MMA said in an announcement last week that the 28-day T-bill rate will be 3.50 percent (down from 7.50 percent), 91-day T-bill rate will be 3.87 percent (down from 8 percent), 182-day T-bill rate will be 4.23 percent (down from 8.50 percent), and 364-day T-bill rate will be 4.60 percent (down from 9 percent).

Criticising the current administration’s “failed economic policies” last month, the main opposition Maldivian Democratic Party (MDP) had said that the budget deficit may increase four-fold if government spending is not reined in.

The government exceeded its budget deficit target of MVR1.3 billion (US$84 million) by the end of May, the MDP’s economic committee observed.

Despite record levels of income from taxes, the MDP said increased recurrent expenditure was forcing the government to rely on T-bill sales, resulting in reduced lending to the private sector as most of the T-bill debt is held by commercial banks.